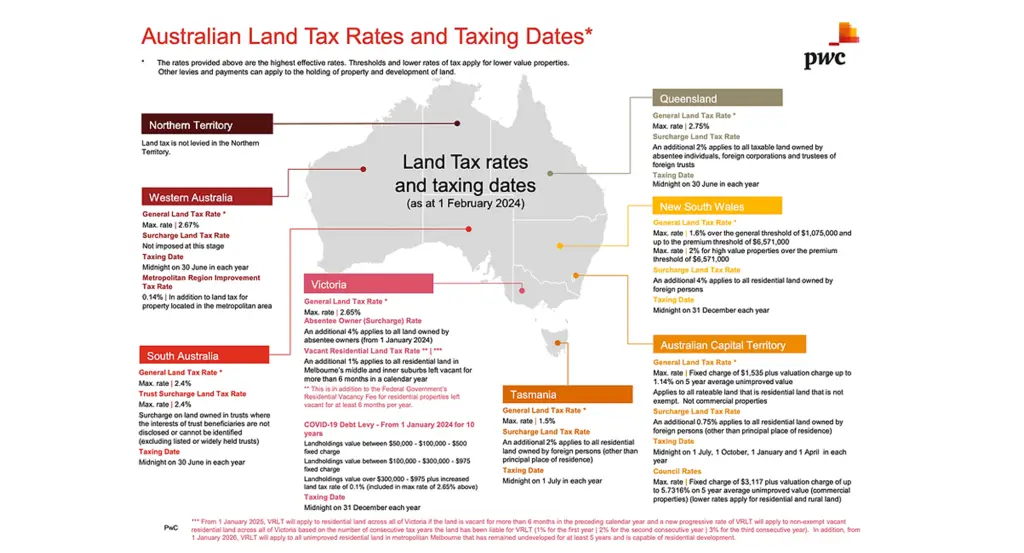

If you’re a property owner in Australia or considering investing in Australian real estate, it’s imperative to understand the land tax implications of your investment. As of 1 February 2024, various changes and updates to land tax rates and taxing dates have been implemented across different states and territories. Here’s a brief guide to what you should be aware of:

Western Australia

The General Land Tax Rate in Western Australia has been set at 2.67%. As of now, there is no surcharge land tax rate imposed on foreign owners, which could be an attractive point for international investors. Taxes are due by midnight on 30 June each year.

Victoria

Victoria’s land tax structure is a bit more complex, with a general rate of 2.65% and an additional 0.4% surcharge applying to all land owned by absentee owners from 1 January 2024. Vacant residential land tax is also applicable in this state, emphasizing the government’s stance on housing availability.

South Australia

In South Australia, the general land tax rate is a bit lower at 2.4%, with a trust surcharge land tax rate of 2.4% excluding listed or widely held trusts. It’s important to note the tax due date of midnight on 30 June each year.

Queensland

Queensland has set its general land tax rate at 2.75% and also includes a 2% surcharge for absentee individuals and entities. The due date for tax payment is midnight on 30 June each year.

New South Wales

New South Wales presents a general land tax rate of 1.6% over a generous threshold of $1,075,000 and up to 2% for properties over the premium threshold of $6,571,000. Foreign persons must be aware of the additional 4% surcharge. Taxes are due by midnight on 31 December each year.

Australian Capital Territory

The ACT has implemented a 1.4% general land tax rate with a fixed charge of $1,535 plus valuation charge up to max. rate on 5 year average unimproved value. This applies to all taxable land that is not exempt. Notably, the ACT doesn’t impose additional surcharges for foreign persons.

Tasmania

Tasmania offers a general land tax rate of 1.5% with an additional 0.75% for all residential land owned by foreign persons. Tax payments are due by midnight on 1 July each year.

Northern Territory

Interestingly, the Northern Territory does not levy land tax, which could be a significant draw for investors looking to maximize their returns.

Key Points for Property Investors

- Keep track of due dates: Each state and territory has its own taxing date, so it’s crucial to mark these in your calendar to avoid penalties.

- Be aware of surcharges: Many regions impose additional taxes on foreign owners, which can considerably affect the overall taxation amount.

- Vacant land taxes: Some states, like Victoria, are penalizing owners for keeping residential land vacant, incentivizing the use of property and contributing to housing availability.

- COVID-19 Debt Levy in Victoria: A specific levy has been introduced in Victoria for landholdings valued between certain thresholds.

- Consider the fixed charges: Aside from the percentage rates, there are fixed charges in some territories based on valuation that should be factored into your budget.

Property ownership in Australia carries various tax obligations, and these land tax rates are a critical part of your financial considerations. Whether you are a domestic investor, foreign investor, or involved in the trust administration of properties, understanding these tax implications is key to making informed decisions.

For bespoke advice and strategies to navigate these taxes, reach out to a specialized tax advisor or property consultant. They can provide insights tailored to your individual situation, ensuring that you remain compliant while optimizing your tax position.