When assessing the growth potential in the property market, several factors play a critical role: economic stability, interest rates, population growth, infrastructure development, and the balance between supply and demand. Of these factors, the equilibrium between the number of dwellings available and the housing demand often directly influences property prices.

At Rising Returns, we evaluate all factors influencing price growth. But today we are going to dive deep into the 2023 dwelling supply status to see which states have a higher upwards price pressure for 2024.

Key Insights:

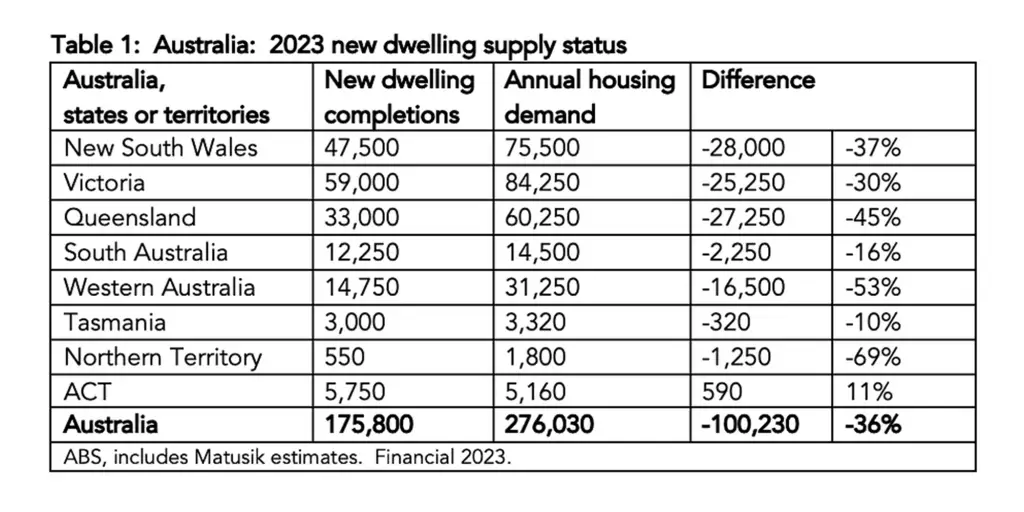

- Understanding the Supply and Demand Mismatch: A snapshot of the 2023 data uncovers a substantial gap between new dwelling completions and annual housing demand nationally. Overall, Australia encountered a deficit of 100,230 dwellings.

- Regions with Pronounced Deficits: New South Wales and Victoria are recording deficits of 37% and 30% respectively. This under-supply in the two most populated states signals an impending rise in property values fuelled by heightened demand.

- Emerging Markets with High Growth Potential: Queensland, Western Australia and the Northern Territory show significant disparities in supply and demand, with differences of 45%, 53% and 69% respectively. These territories will experience substantial growth, as constrained supply often spurs price escalation.

- Stable Markets: The ACT’s undersupply is not quite as dire as in other states, evidenced by a modest variance of 590 dwellings. Compared to other regions showing strong growth trajectories, the ACT has relatively limited potential for capital gains, making it a less attractive option for investors.

The evident under-supply in numerous Australian territories indicates regions ripe for growth. Queensland, Western Australia, and the Northern Territory are primed for higher gains than the other states.