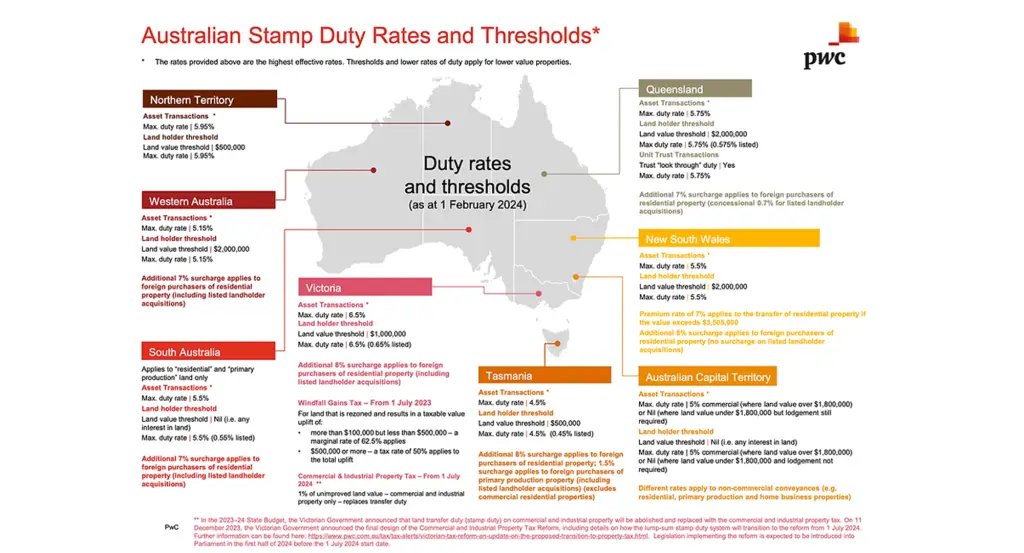

Navigating the landscape of property taxes can be a daunting task for potential property buyers in Australia. With each state and territory having its own set of rules and rates, it’s crucial to stay informed. As of 1 February 2024, there have been significant updates to stamp duty rates and thresholds across the country that could affect your property investment decisions. Here’s a snapshot of what you need to know.

Northern Territory

The Northern Territory maintains a maximum duty rate of 5.95% with a notable land value threshold of $500,000. Investors should take note of this as it could impact the overall cost of acquiring property in this region.

Western Australia

Western Australia sets its max duty rate at 5.15% with a land value threshold of $2,000,000. An additional 7% surcharge applies to foreign purchasers of residential property, which includes landholder acquisitions.

South Australia

Here, the focus is on ‘residential’ and ‘primary production’ land only. South Australia’s maximum duty rate sits at 5.5% with no explicit land value threshold. Foreign investors should be aware of the additional 8% surcharge.

Victoria

Victoria has set its max duty rate at 6.5% with a land value threshold of $1,000,000. Much like South Australia, an 8% surcharge is levied on foreign purchasers of residential properties. From July 2023, Victoria also introduced a Windfall Gains Tax and a Commercial & Industrial Property Tax, reflecting a shift towards taxing the unimproved value of land.

Queensland

Queensland’s max duty rate is at 5.75% with a higher land value threshold of $2,000,000. It’s also important to highlight that there is an additional 7% surcharge for foreign purchasers of residential property, with a concessional 0.7% for listed landholder acquisitions.

Tasmania

The island state sets its max duty rate at a more modest 4.5%, with a land value threshold of $500,000. Foreign buyers should note the additional 8% surcharge applied to their transactions.

New South Wales

New South Wales presents a max duty rate of 5.5% and a land value threshold of $2,000,000. However, a premium rate of 7% applies to residential properties over $3,500,000, signaling a significant additional cost for high-end property investments.

Australian Capital Territory

The ACT is unique with no explicit max duty rate but applies different rates to non-commercial conveyances. The focus here is on commercial where land value over $1,800,000 has specific considerations.

What This Means for You

Whether you’re a first-time homebuyer, an experienced investor, or a foreign entity looking to acquire property in Australia, understanding the current stamp duty rates and thresholds is vital. The variations across states and territories mean that the location of your property can significantly influence the amount of tax payable upon purchase.

Before proceeding with any property transaction, consider consulting with a property advisor or financial professional who can help navigate these complexities. For foreign investors, the additional surcharges across various regions highlight the importance of incorporating these costs into investment strategies.

Remember, while stamp duty is a considerable expense, it’s just one part of the overall financial equation when it comes to property investment. With the right strategy and advice, you can make informed decisions that align with your financial goals.

Note: The details presented in this post are based on the latest available information as of 1 February 2024. For the most current rates and legal advice, always consult with a professional.